Consortiums of companies have much more to contribute than just investment — they provide safety, expansion, and a partnership in a journey that is always hopeful. Their power rests in how impeccably they juggle various markets, evolve in the ever-changing times, and go in for a guiding principle. What we want to achieve at Roongta Group is a business that is sustainable, financially productive and primarily people-oriented. We are on the lookout for those investors who are on the same page with us that it is possible to create a legacy that outlasts the trends of the market. Interested in making an investment that will appreciate over time and in values? Dip into the Roongta world — where several sectors converge to one solid future and a new paradigm is born.

In this rapidly changing world, investors are in a continuous search for safe and stable investments. Many investors find diversified business groups to be the best place to invest and these are the companies that operate in numerous industries under one brand. These business houses are not just stable in one sector but also expand their respective fields to many more areas.

In Roongta Group, diversification is the key factor for the future. After having set its foot in the field of real estate, finance, hospitality, manufacturing, and others, the group remains to be an indispensable creator and protector of wealth, safety and growth for everybody — mainly the long-term investors.

Nevertheless, what is it in diversified business groups that make them most appealing to the investors? Let us find out.

1. Stability in Uncertain Times

In economics, when the downswing in one sector is equated to an upswing in the other, we talk about the diversification principle. To give an illustration, while the real estate business slows down, the manufacturing or retail sector might still be profitable to a business group. This balanced mixture of different units is actually the backbone of not only the company mainly but the whole group as well.

Investors perceive of it as a safe guard or a guarantee. Investors could be sure of the fact that during even very tough economic times a diverse group is much more likely to survive and prosper than a company that is in a single industry.

2. Multiple Income Streams

Diverse groups derive income from a variety of business fields (businesses), indicating that their money is not coming from a single source alone. Sales of properties, software services, accommodation, or goods for example, they all contribute to the business sector.

Investors have some benefits from it. They will have continuous returns even in the case of a sector deceleration if others function and create cash flow, which obviously makes the group a safer investment. Despite the pandemic putting brakes on many industries, the liquor industry remains one of the sectors that best coped with the recession. Therefore, a diversified portfolio spans sectors that may not be negatively impacted and at the same time reach those that are positively affected.

3. Strong Market Presence and Brand Value

If a business group gets its fingers into multiple pies, it’s easy to make a strong brand name. People no longer see it only as one market but almost anywhere. A group may become very popular in the real estate business but when it diversifies into becoming a retail brand it can still retain its brand value.

Vested loyalty across the different industry sectors fuels a companies’ speed to growth, and in return, the spread of services results in a larger customer base. The fact that a brand is good means that the costs of marketing are low and the amount of trust that would be expected to be present in the new market comes in much faster, so the investors are then happy with it.

4. Experienced Leadership & Vision

An experienced and market-knowledgeable founder or director is usually the one who takes charge of the diversified business groups. Such a person knows the right time to invest and create new teams besides taking risks that are under the control of each of the divisions.

The leaders of the Roongta Group carry out the strategy of developing the business through decency, durability, and future-oriented that not only increase the company’s value but also generate the loyalty of investors.

5. Risk Reduction

A single-industry company is more prone to risk due to the fact that if this particular sector goes through a crisis, the company as a whole will be in jeopardy. The real differentiator in a diversified group is that if one area encounters losses, another section can still make profits to overcome the deficit.

The ability to lower the risk is the major drive of trust for the business group for investors with a long-term strategy. It lets them be feeling stable while putting their money into such a structure that has a lot of alternatives to make money.

6. Opportunity to Enter Growing Markets

New and upcoming industries have always been dominated by conglomerates having interests in various sectors such as renewable energy, technology, fintech, and healthcare. This dynamic also prepares them for the future and allows investors to capitalize on the initial growth of such markets.

Roongta is the perfect example of such a collective group. It can leverage its accomplishments, contacts, and assets to scout the new markets much expeditiously and efficiently than the startups or the companies confined to one industry.

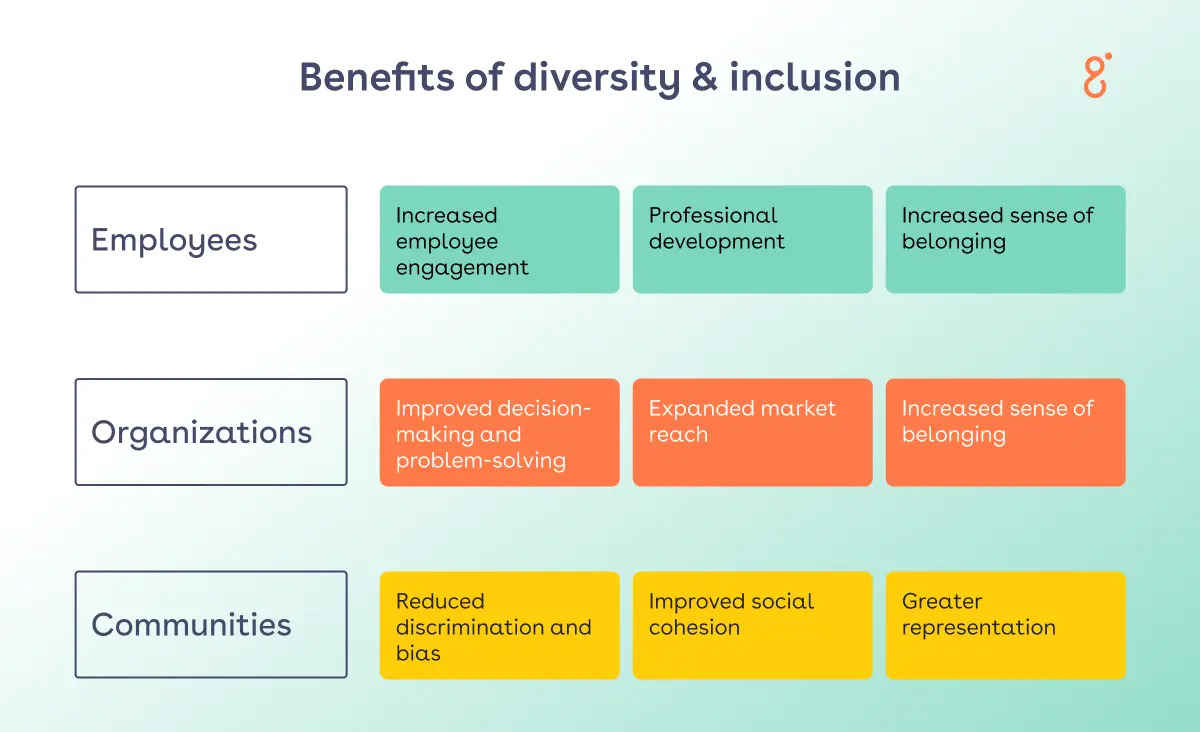

7. Strong CSR & Sustainability Image

Primarily, most business groups are in the execution of Corporate Social Responsibility (CSR). They perform different charitable initiatives, protect the nature, as well as get involved in education and health.

It benefits the society greatly and at the same time it attracts the attention of potential investors. The current investors — particularly the ones who are involved in the global market — check the companies that are driven by a certain cause and are not entirely profit-oriented.

8. In-House Resources and Ecosystem

The IT teams, HR departments, legal units, branding experts, etc., are all part of the large business groups. These groups can offer stable new companies and make them efficient when one talks about their in-house systems.

They do not reinvent the wheel on every occasion — utilization of the ecosystem to save the costs and increase the speed is their chosen way to go. Investors also benefit from it: it further indicates that they have now less delay, less wastage, and more output.

9. Visibility and Public Image

Events, news, and awards often include groups from different parts of the society. The leaders of these groups engage in panel discussions, while their work is showcased through the media. The public’s perception is of great importance, it is directly proportional to the brand and investor performance.

Our organization, Roongta Group, is enthusiastic to share the information about our journey, achievements, and future plans via our website, blog contents, and media updates. Full disclosure and open communication are the building blocks for building the trust of our investors.

10. Long-Term Vision with Real Results

The primary reason why long-term investors prefer diversified business groups is their vision that is converted into reality. The key feature of these groups is that they not only promise but also move from words to action. They improve their strengths over time, broaden their operations, and enhance their reputation for a steady and continuous performance.

For example, Roongta Group has always consistently provided added value in the primary verticals that it has chosen. Be it urban development or smart technologies, every move is congruent with the next.

Final Thoughts

Consortiums of companies have much more to contribute than just investment — they provide safety, expansion, and a partnership in a journey that is always hopeful. Their power rests in how impeccably they juggle various markets, evolve in the ever-changing times, and go in for a guiding principle.

What we want to achieve at Roongta Group is a business that is sustainable, financially productive and primarily people-oriented. We are on the lookout for those investors who are on the same page with us that it is possible to create a legacy that outlasts the trends of the market.

Interested in making an investment that will appreciate over time and in values? Dip into the Roongta world — where several sectors converge to one solid future and a new paradigm is born.

RECOMMENDED FOR YOU

Breaking Barriers: The Inspiring Stories of 7 Women Entrepreneurs Who Defied the Odds to Create Thriving Businesses